CX STRATEGY / @FJONG / New product Development

FJONG Subscription

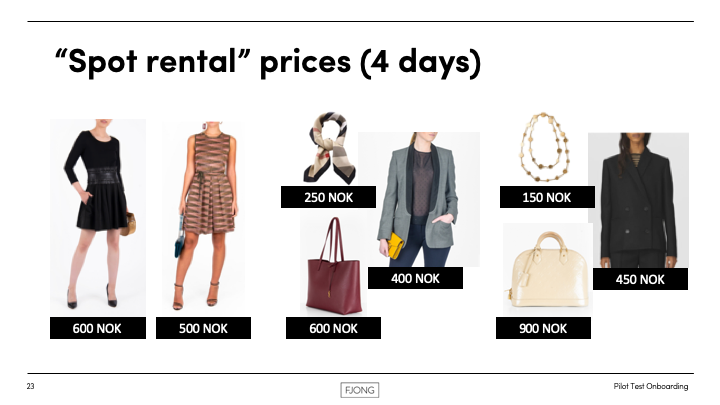

In 2016, FJONG’s founders realized that many women in Norway felt stressed finding something to wear everyday, felt guilt and frustration from having many clothes in their closet they rarely used, and shopped because they wanted the feeling of “something new” although they didn’t really need anything. To address these problems, they launched a clothing rental service, where users can rent items and lend out their unused items. This service has attracted over 50,000 users to date, proving the concept is attractive to Norwegian women.

UNDERSTANDING CONTEXT

DEFINING THE PROBLEM

The most popular 25% of items (which are almost all special occasion dresses) account for 87% of all orders.

From the business perspective:

Despite attracting large numbers of users, FJONG was facing a problem—very few of those users were actively renting. Those that were renting did so no more than once or twice per year, when they would rent dresses for weddings, Christmas parties or other special occasions. As a result, the most popular 25% of items in FJONG’s inventory (special occasion dresses) accounted for almost 90% of all orders, and nearly 60% of FJONG’s inventory had never been rented out a single time (incurring storage and operational costs without generating sales). In order to become a sustainable business, FJONG would need to reduce the seasonality of its cash flow by encouraging customers to rent year round for all sorts of occasions.

From the customer perspective:

The core customer problem FJONG’s founders aimed to address was the stress women felt to be well-dressed on a daily basis. Yet when given the opportunity to rent all types of clothes from FJONG, customers choose not to rent outfits for work or everyday occasions. This raises the obvious question: why not?

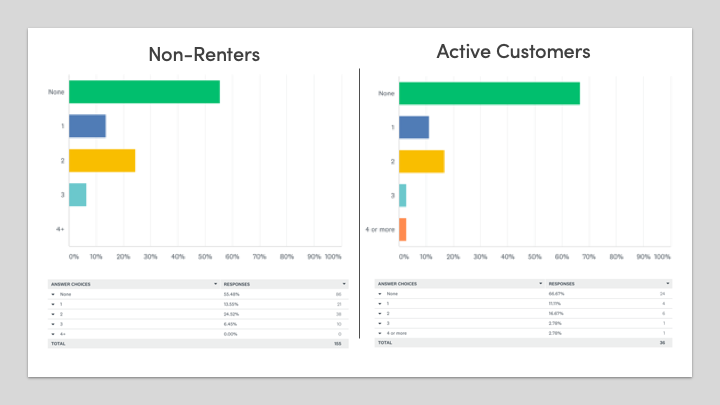

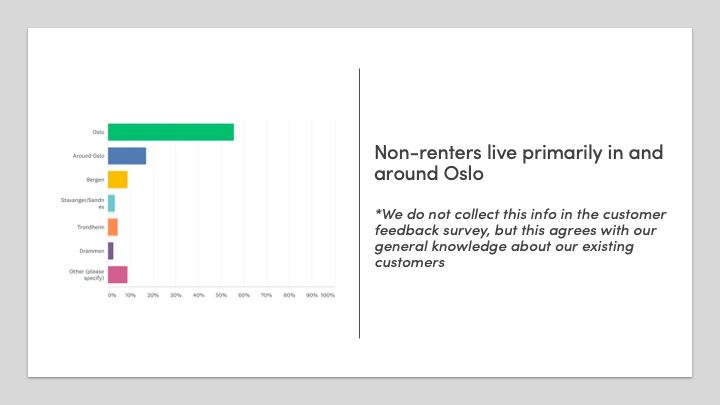

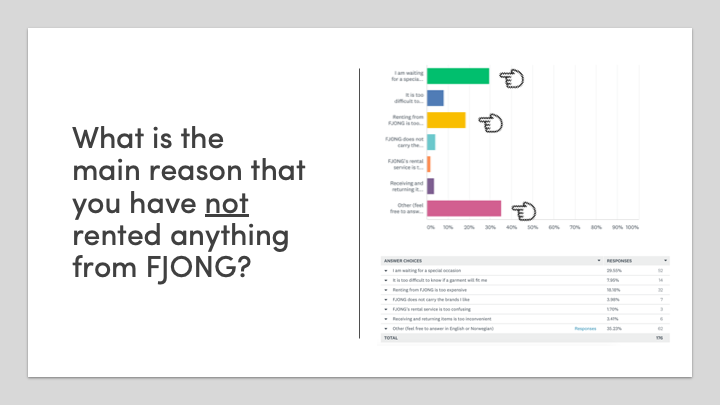

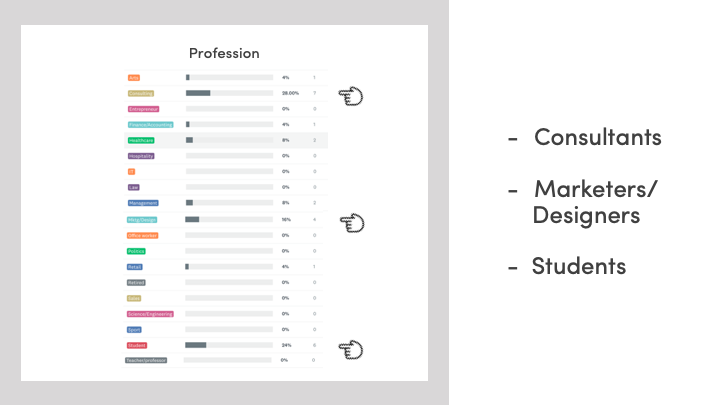

To investigate this further, I sent a survey to users who had signed up but not rented anything from FJONG to better understand the reasons why they were not renting. The survey revealed that non-renters where a not different from renters demographically, but rather than they were were simply waiting for a special occasion to rent, which had not yet occurred. Secondary reasons were that they found renting too expensive or inconvenient.

To flesh out this perspective, a handful of interviews with customers revealed the most common reasons they used FJONG only for special occasions were:

1. The current rental process is inconvenient (expensive and time-consuming) and they are only willing to do it for special occasions where they really care about their outfit.

2. They are more likely to invest in purchasing their own casual and workwear items because the cost-per-wear for items that are worn frequently is much lower.

IDEA GENERATION & EVALUATION

FJONG needed a solution to their business problem that would also address their customers’ needs. It would need to:

Encourage customers to rent more consistently (by addressing the issues of inconvenience and cost)

Make use of dormant inventory

Stabilize inconsistent, seasonal cash flow

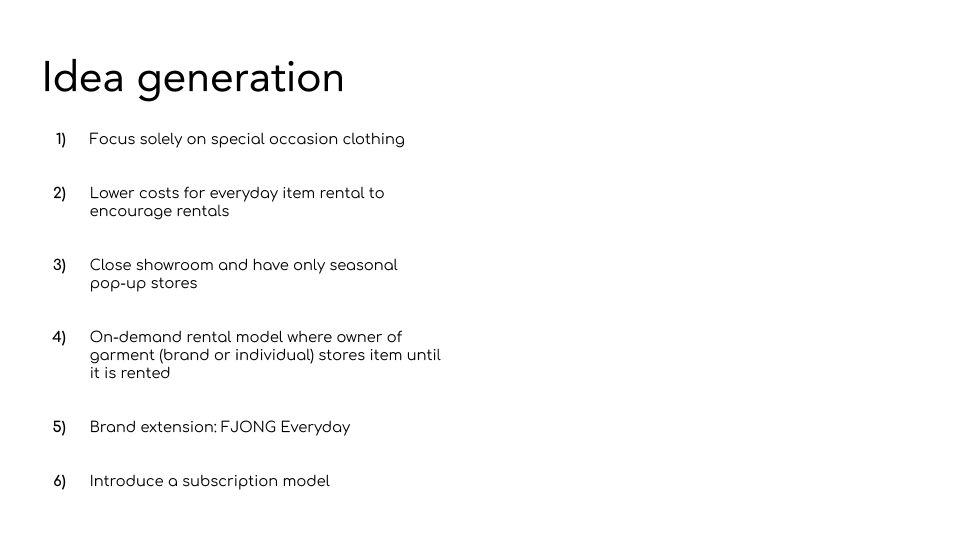

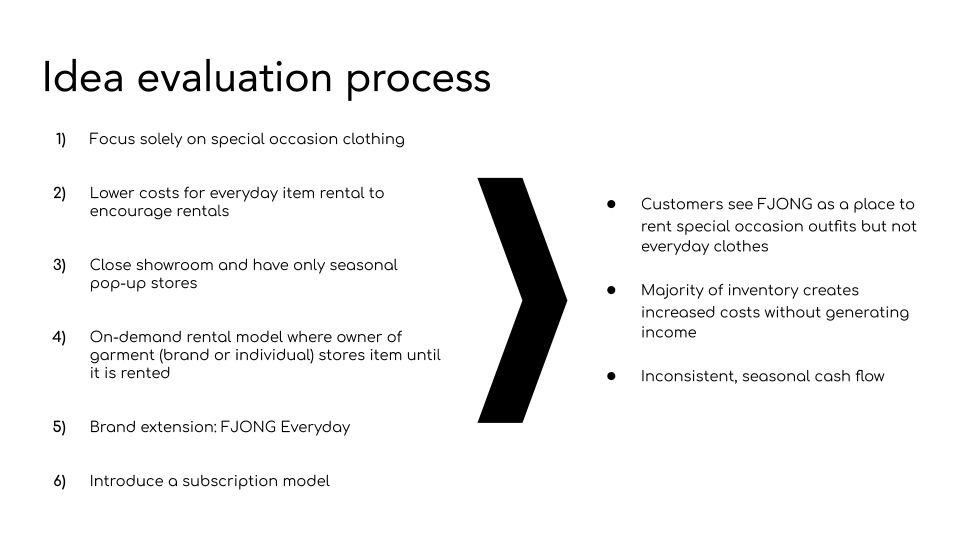

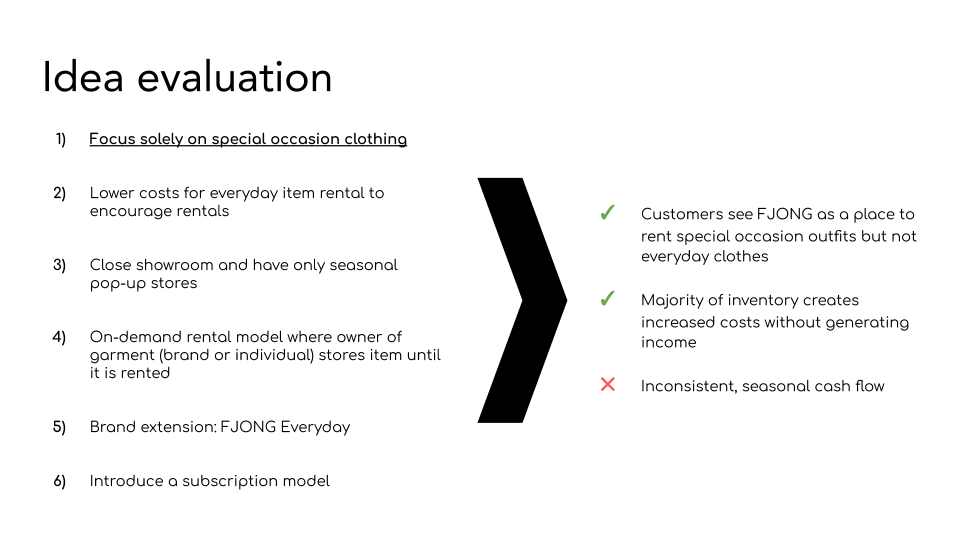

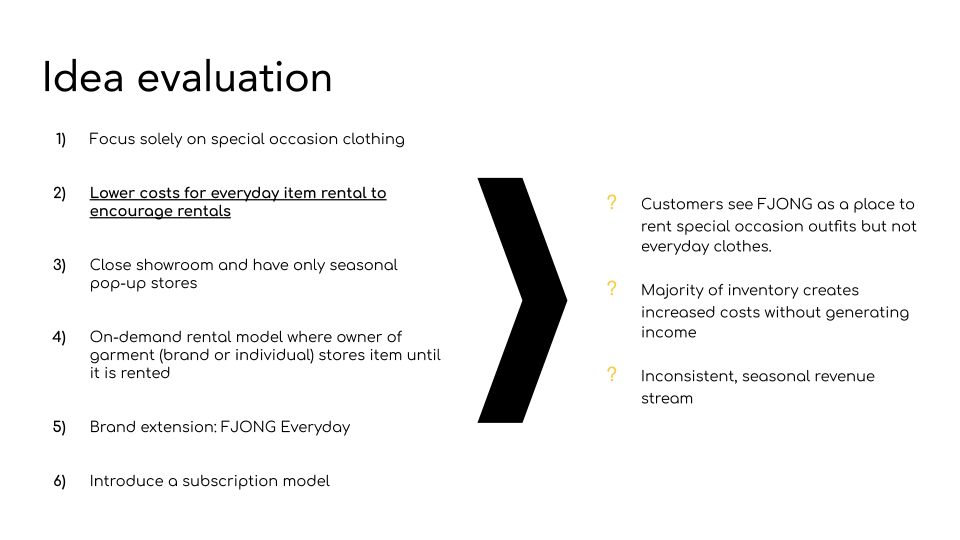

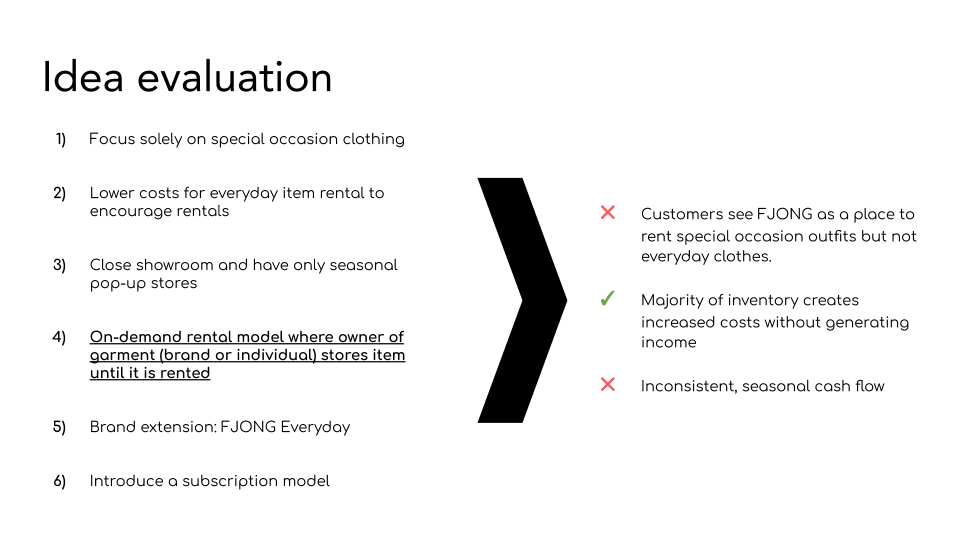

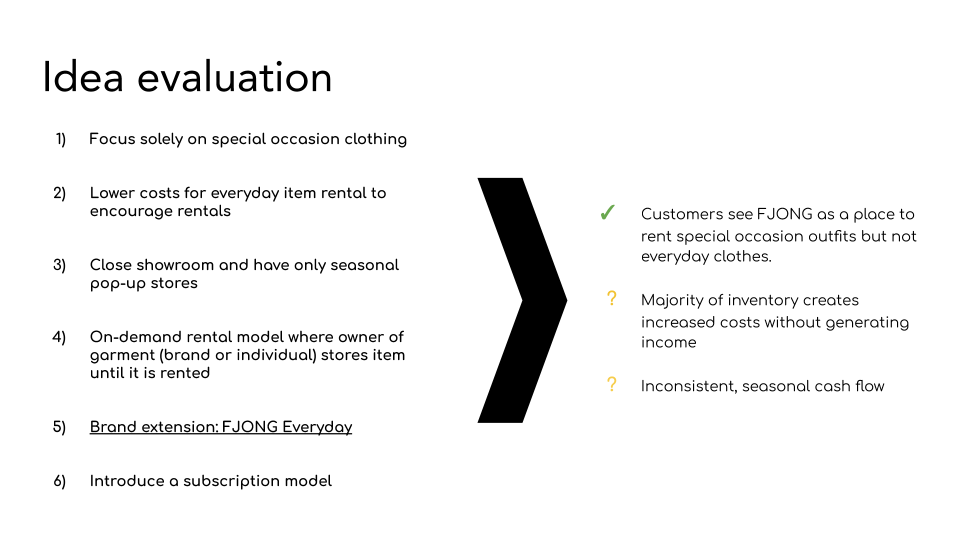

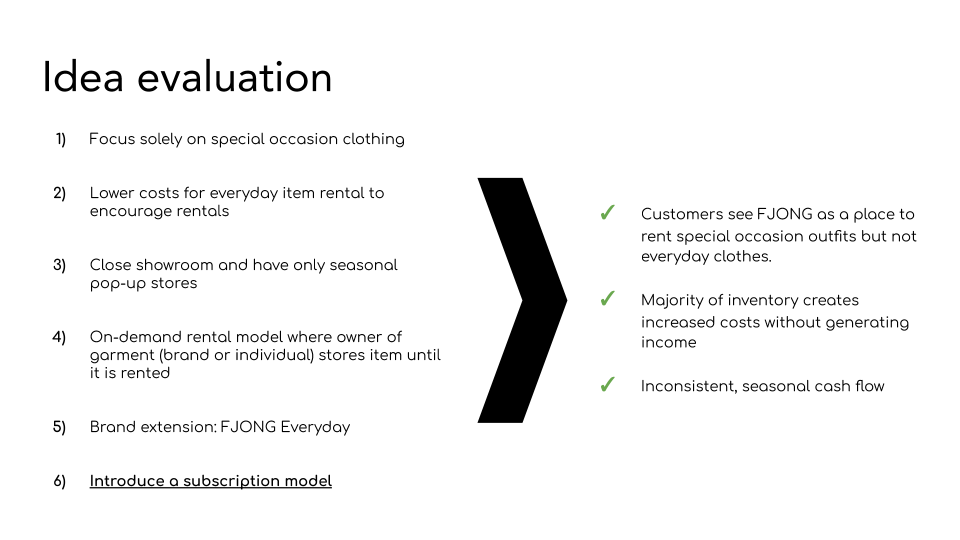

Several ideas were generated from group discussions with FJONG employees and management. Each idea was then evaluated on the basis of how will it would address the three points above.

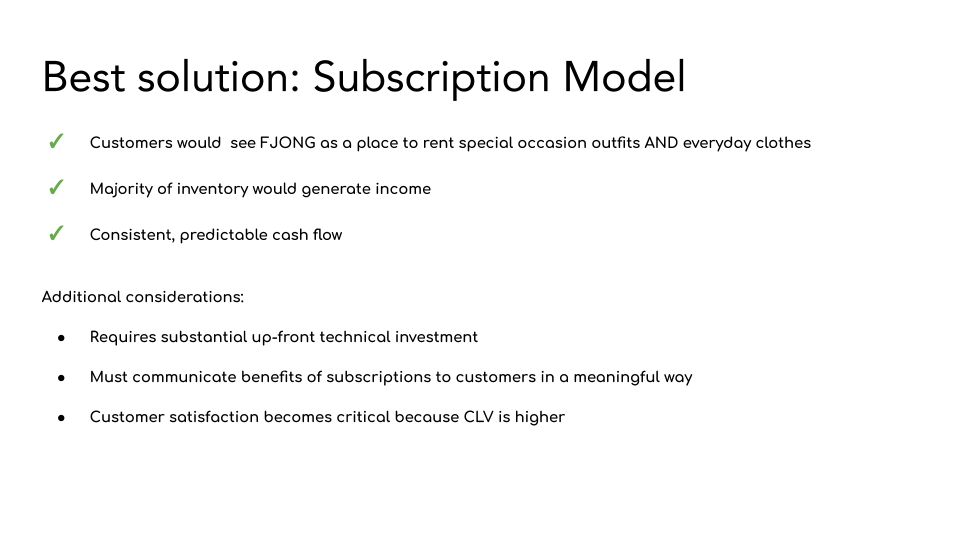

FJONG’s management team saw a likely solution in launching a new product: FJONG subscription. From the business perspective, subscriptions would encourage customers to rent from FJONG on an everyday basis, put casual outfits into circulation and provide a more stable and predictable cash flow. From a customer perspective, subscriptions would make it simpler and less expensive to rent everyday items.

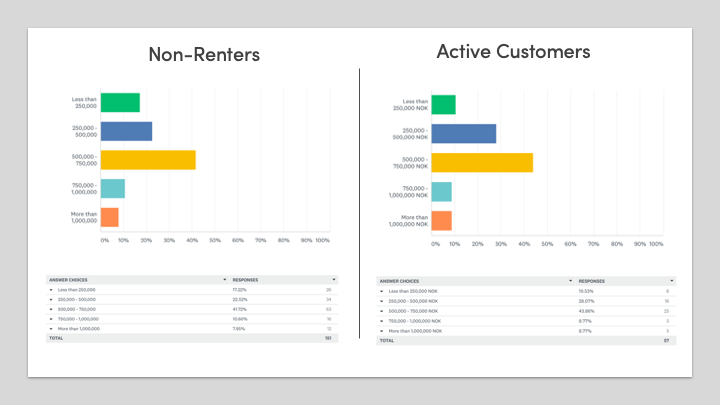

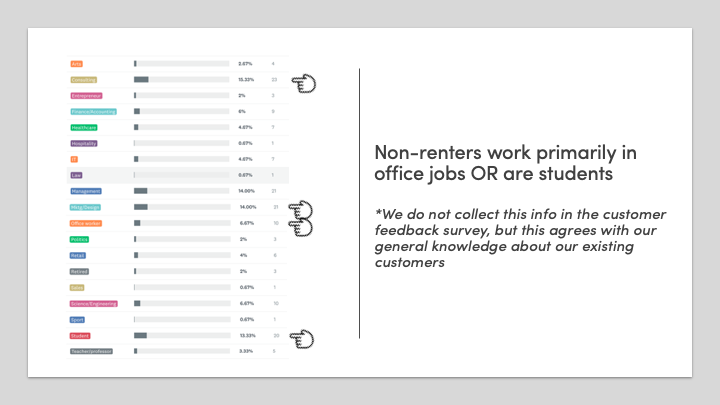

This idea was also very timely. A 2018 McKinsey report found that the subscription e-commerce market had grown by more than 100% per year over the past five years and that most e-commerce subscribers tend to be very similar to FJONG consumers: younger, urban women with a good salary (~ 400,000-800,000 nok).

REFINING THE IDEA

FJONG’s COO, Ioana Arghir, and I were tasked with taking ownership of FJONG subscriptions, with the goal of a launching a sustainable, scalable and eventually profitable service offering as quickly as possible.

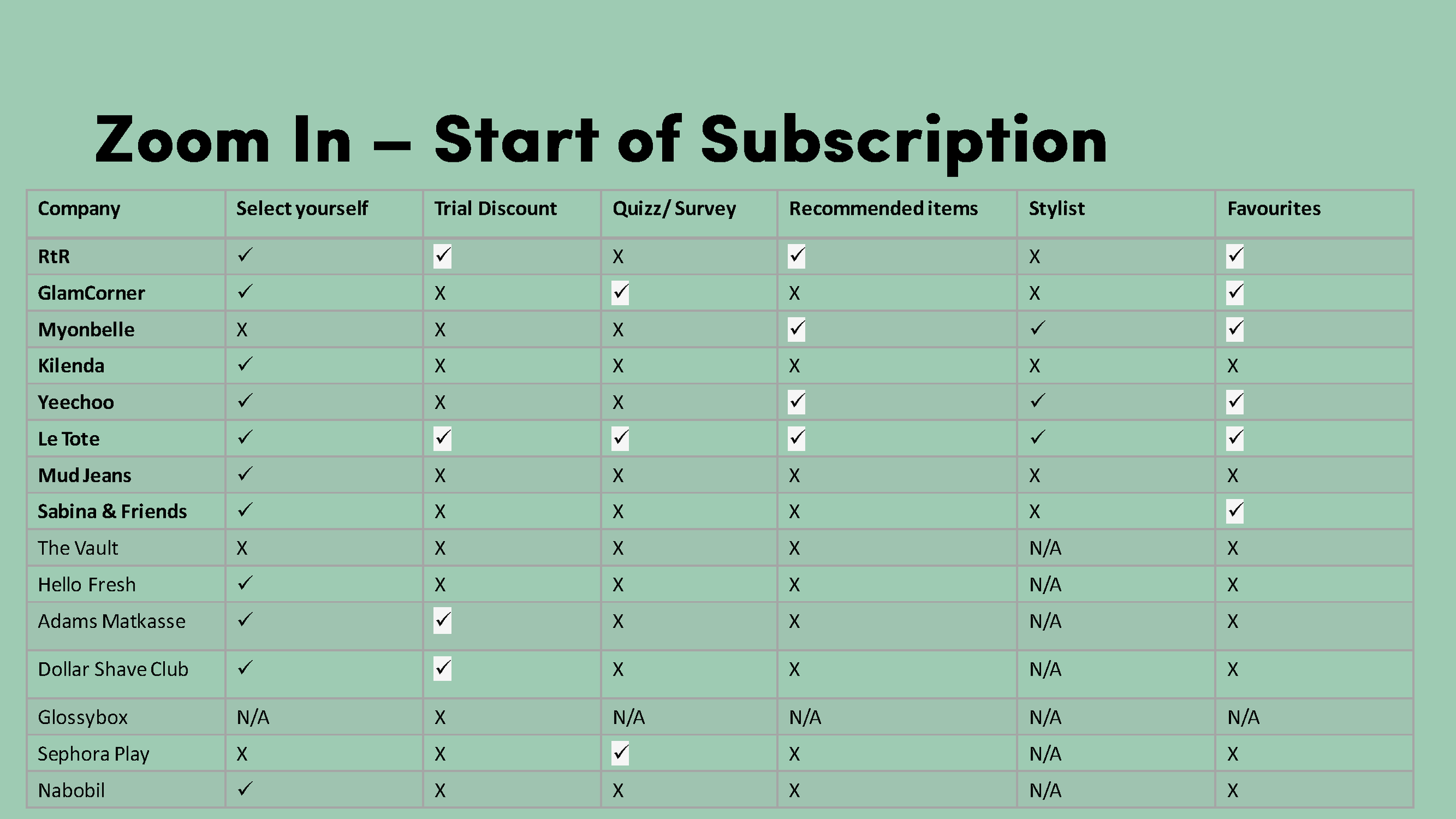

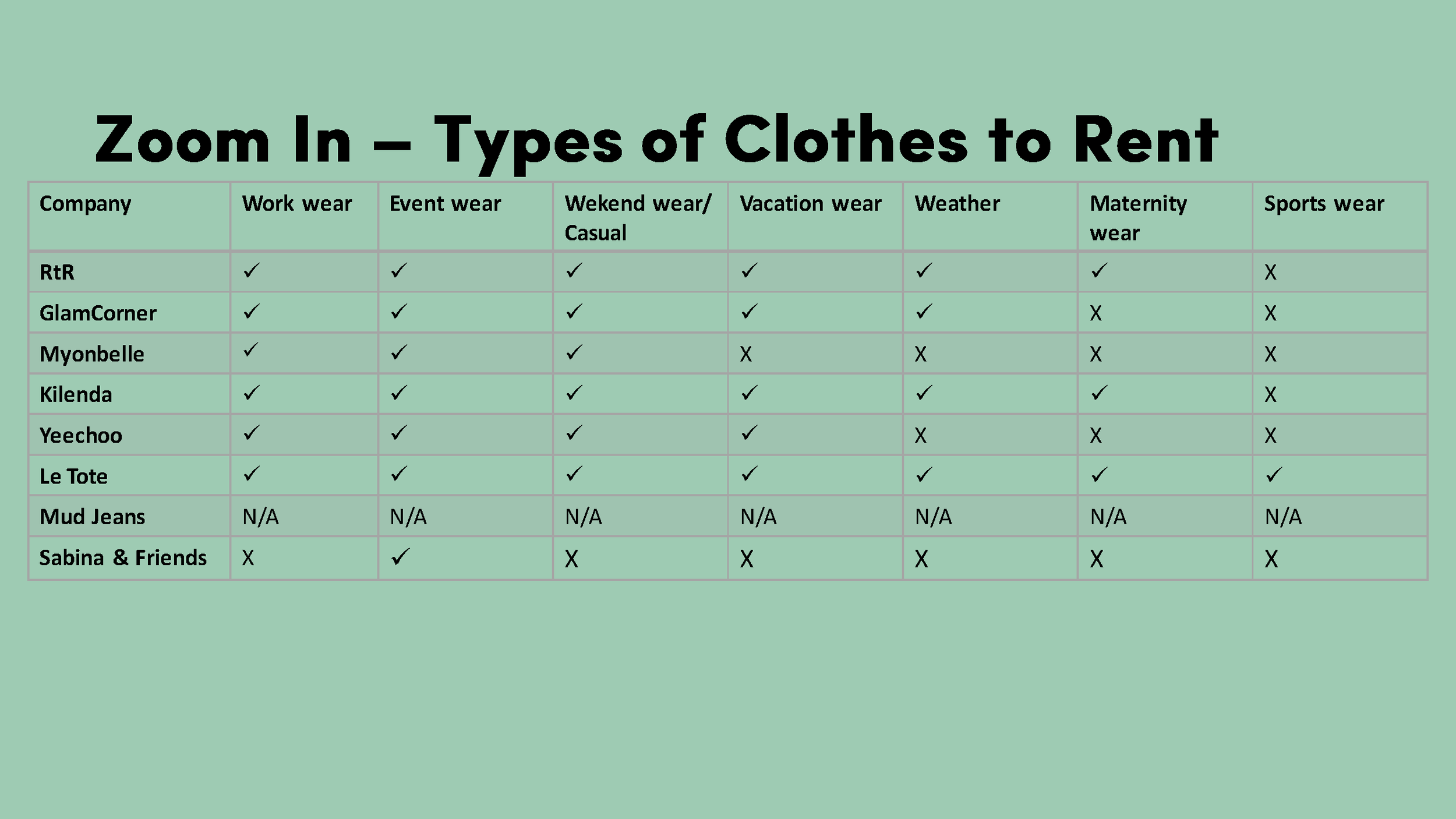

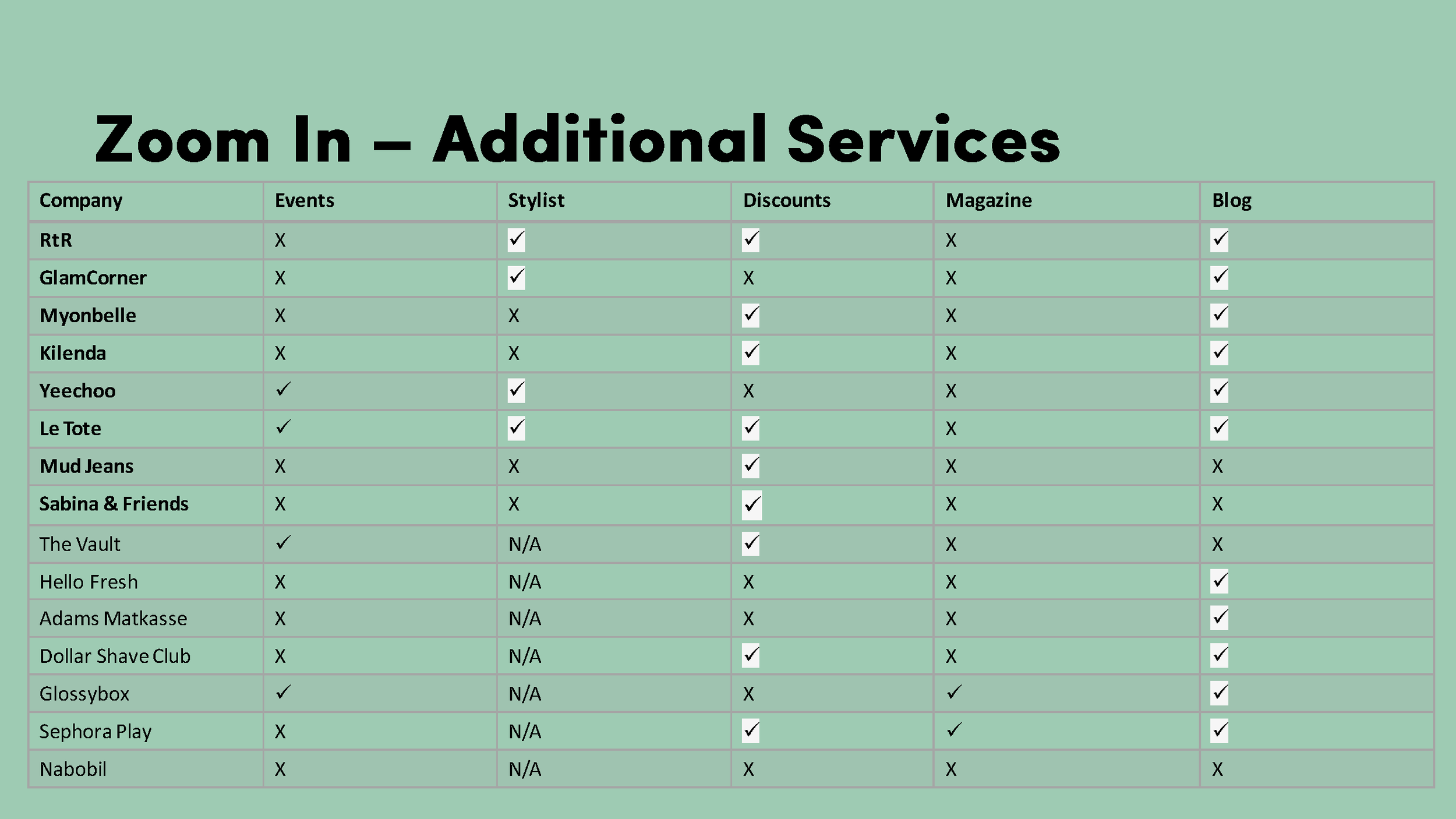

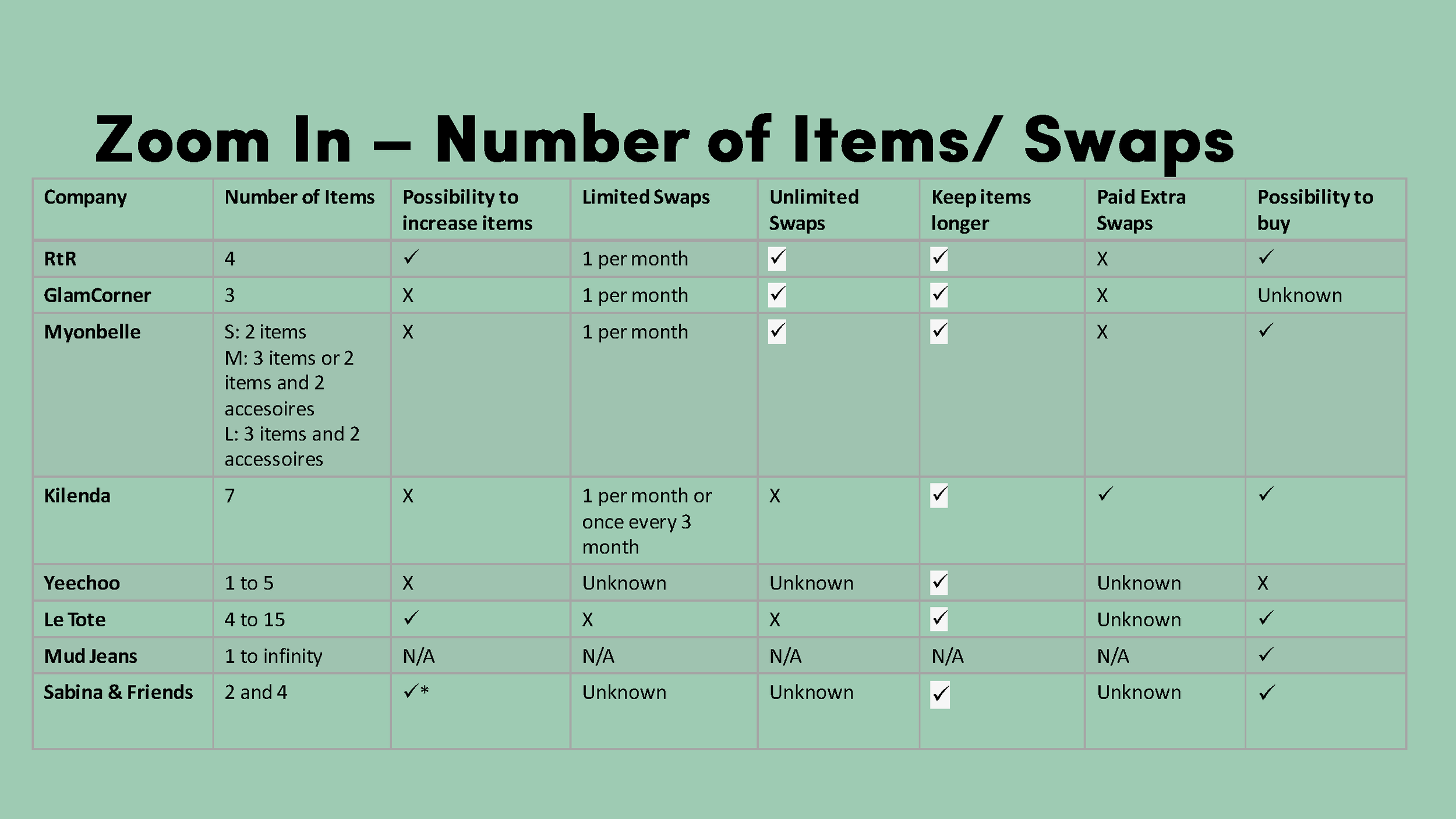

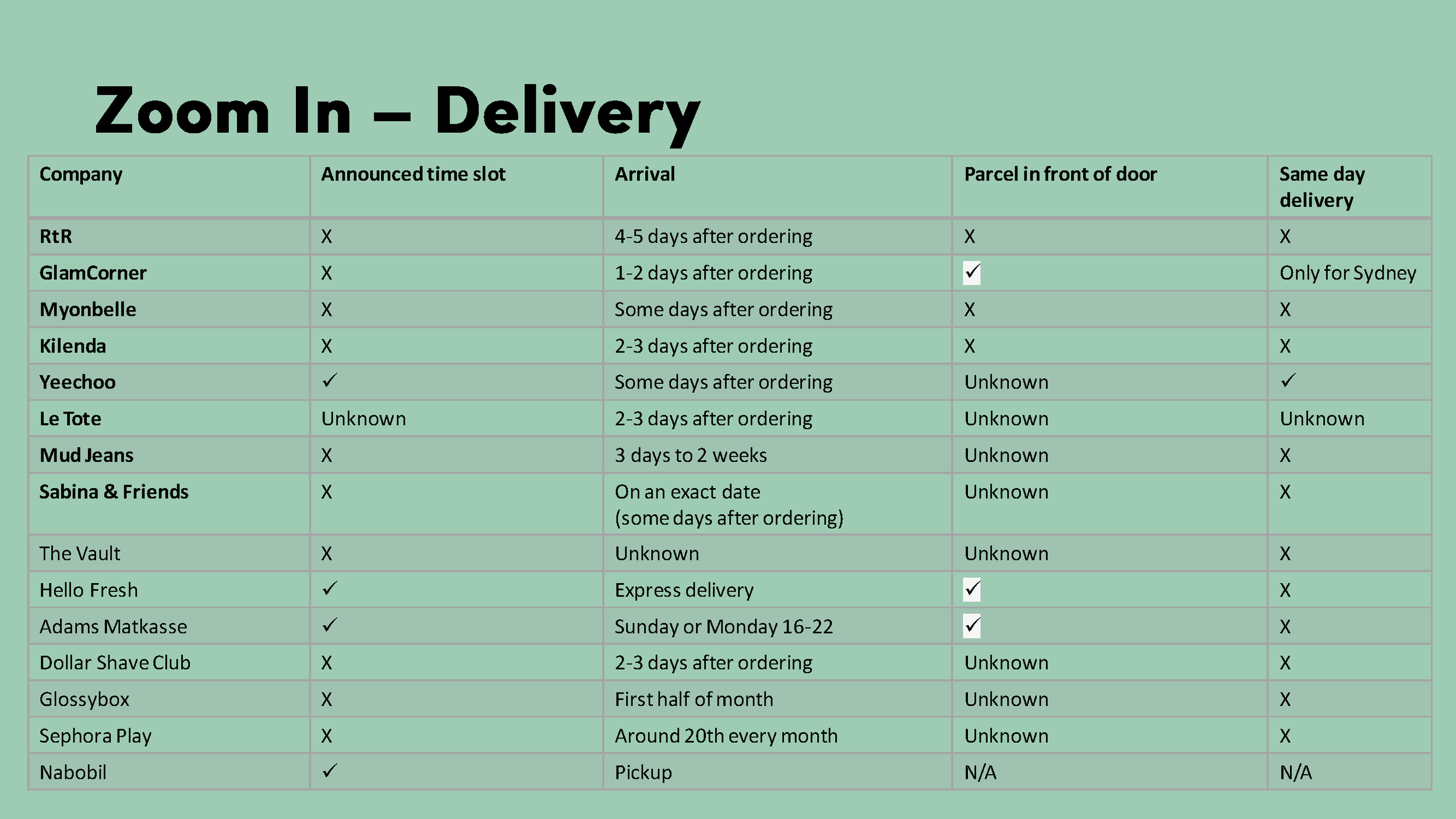

We began by collaborating with master’s students at a local university to conduct an industry analysis to get a better idea of the competition and commercial considerations surrounding clothing subscriptions. Since there was not a comparable service in Norway at this time, we focused on analyzing the onboarding process, types of clothing for rent, number of items for rent, swap options, price, delivery options and additional services of international clothing rental companies such as Rent the Runway, GlamCorner, Myonbelle, Kilenda, Yeechoo, Le Tote, MudJeans and Sabina & Friends, as well as a handful of other (non-clothing) subscription services.

This analysis revealed that while clothing subscription services were becoming increasingly popular globally, there was little agreement on how the service was defined. Not only did the number of items included in a subscription and the time between swaps vary, but subscriptions services also varied in many other ways. Some subscriptions required all items to be exchanged on a regular schedule while others allowed each individual item can be exchanged for another at any time. Some subscriptions allowed the customers to choose exactly what items they wanted, other had stylists choose items for the customer based on their stated preferences. Some subscriptions allowed customers complete access to their entire inventory, while others limited subscribers to a subset of their inventory or completed separated subscription inventory from one-time rental or purchase inventory. To offer an attractive subscription to FJONG users, we could not just adopt an “industry standard”—we needed more information about the specific wants and needs of our users.

USER RESEARCH

To begin understanding what FJONG users would value in a subscription service, we sent out a survey. Respondents were asked:

What sort of clothing they would want included in their subscription (asked to choose between categories and provide open-text feedback)

Then they were randomly presented with one of four subscription models (three items/monthly swaps, five items/monthly swaps, three items/unlimited swaps, five items/unlimited swaps)

They were asked to rate their likelihood to try and willingness to pay for the presented model, and prompted provide open-form feedback about what type of model they would prefer or other feedback.

This survey was helpful in clarifying certain assumptions. For example:

There was clear interest in FJONG subscription as a concept (over 1000 users took the time to take the survey, and 600 of them subscribed to an email list be kept updated about the service).

Respondents were demographically very similar to existing FJONG spot-rental customers, suggesting that the subscription could be launched in the current market.

The majority of respondents (70%) had never rented with FJONG before, suggesting that the subscription service would indeed appeal to users with different motivations than current spot renters, thereby serving as effective tool to acquire new customers.

But other things were less clear. Preferences for the types of clothing to be included, prefered model (number of items/swaps) willingness to pay and attractive add-on services varied widely. This variety of expectations and preferences were confirmed in qualitative interviews. Interviewees were all excited about the possibility of a FJONG subscription, but each had very clear, and very different, definitions of what that service would look like. They expected to have access to different types of items, for different durations of time and some placed significant value on recommendations, while others wanted to full control to choose their items by themselves.

Interviewees were all excited about the possibility of a FJONG subscription, but each had very clear, and very different, definitions of what that service would look like.

This wide variety of preferences and inconclusive quantitative analysis revealed several significant risks.

Market risk: There is clear interest in the concept of a FJONG subscription, but would there be sufficient demand for a single, defined subscription model? Waitlisters are mostly not active FJONG customers—why are they not already renting consistently from FJONG and using the current service as their own “subscription” (cost? convenience?)?

Development risk: Lack of clear trends in customer desires mean the risk is high to develop features with little customer value (or to not develop features with high customer value) leading to significant losses in time and/or money.

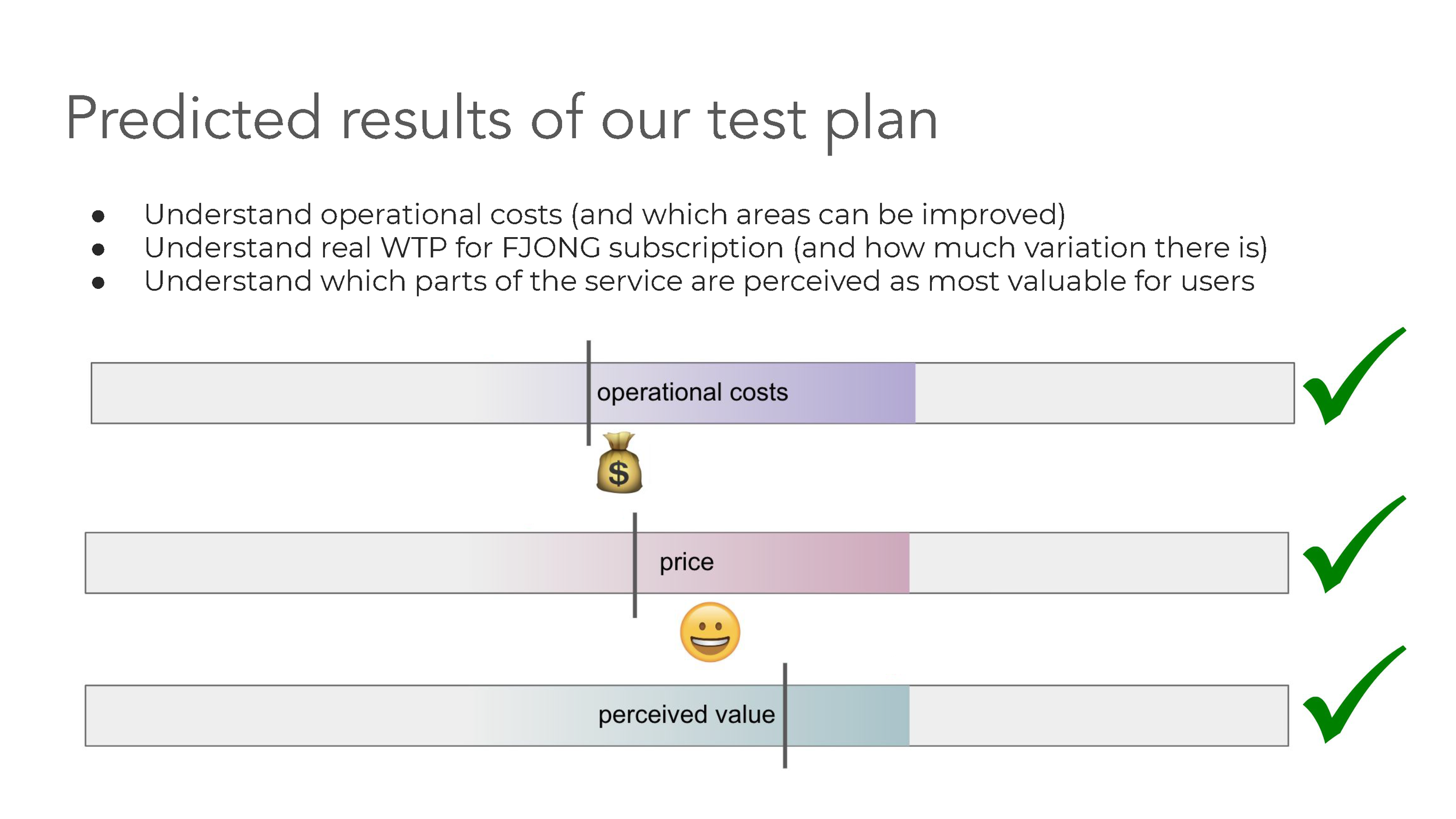

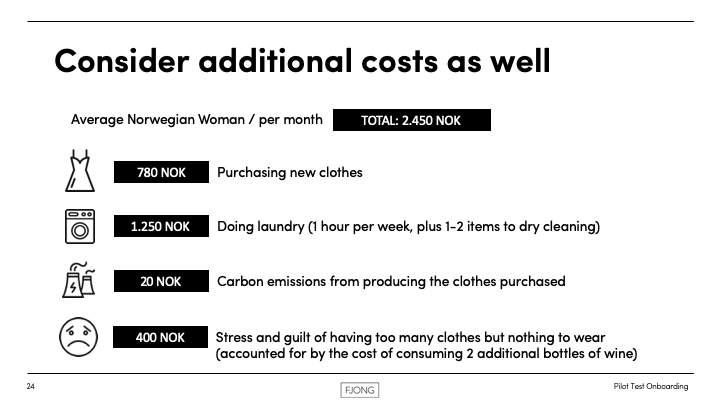

Financial risk: Willingness to pay in the survey was quite low, well below theoretical operating costs, but knowledge about the service is also very low at this point. Would true willingness to pay be higher? What would be the true operating costs for a desirable subscription model? To be sustainable, a subscription must be attractive to the customer and to FJONG (in the long term).

DESIGNING A PILOT TEST

“The world is littered with failed businesses that banked on people’s attitude toward hypothetical products and services. In speculative surveys, people are simply guessing how they might act or which features they’ll like; it doesn’t meant they’ll actually use or like them in real life.”

With these risks in mind, we concluded that to move forward we needed do more user research. Since the self-reported survey data was so inconclusive, we wanted to observe actual user behaviour around a FJONG subscription.

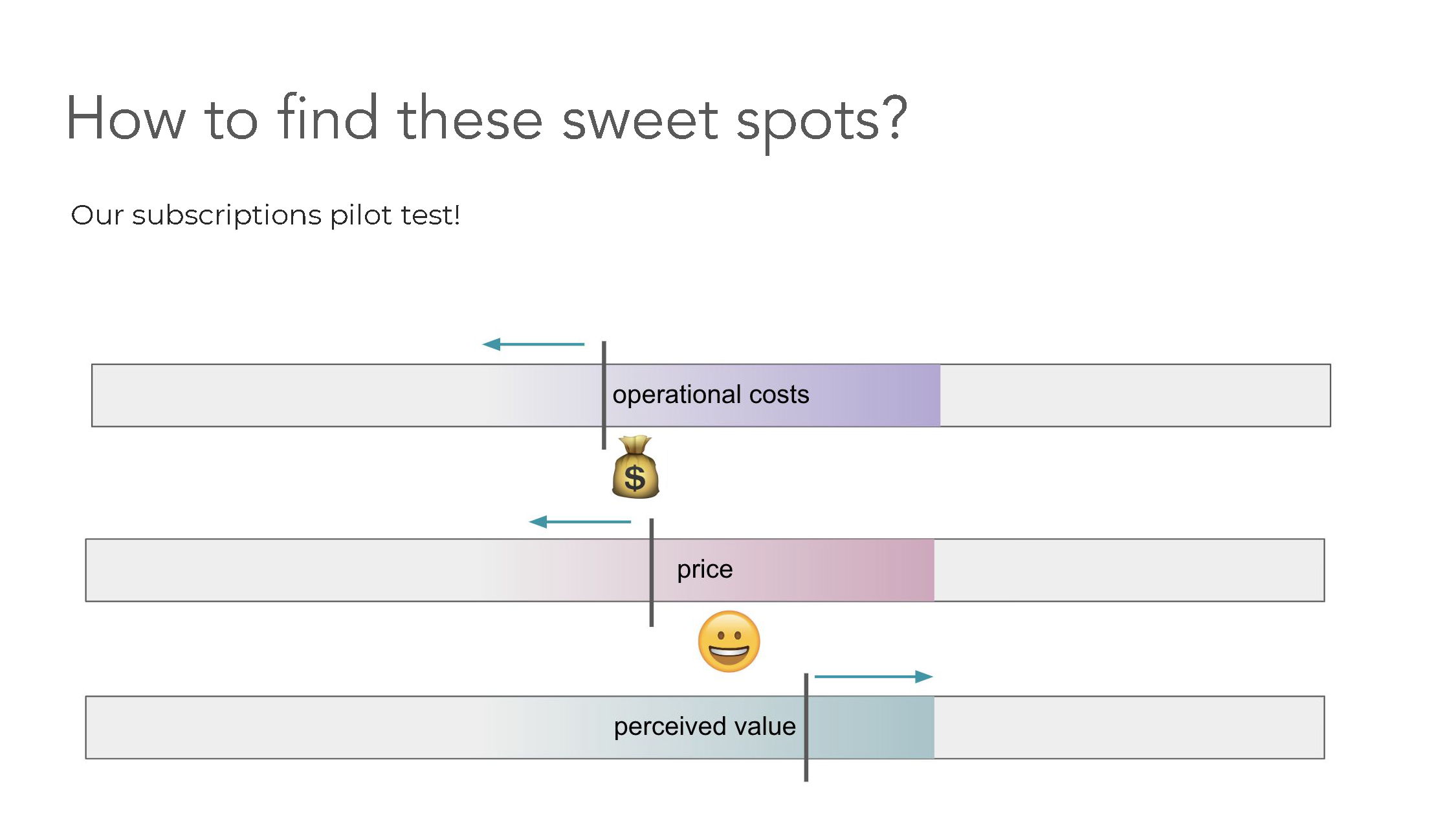

Since a FJONG subscription did not yet exist and would be extremely difficult to emulate realistically with a prototype not integrated into FJONG’s live inventory platform, we concluded that the best option was to develop a minimal subscription platform (developing only those features that would be necessary for any future subscription model) and conduct a pilot test with a limited number of users.

We would use this subscription pilot test to better define our customers’ needs and determine the most cost-effective way to meet those needs. Then we would iterate on the pilot subscription to launch a viable beta subscription (a model proven attractive to users and that FJONG is able to support operationally) to prove the concept in our target market and build upon.

The concept of our pilot test would be to offer as flexible a subscription model as possible in order to observe natural customer behaviour. This flexibility would allow us to observe subscription customers’ behavior and desires, identify which additional technical functionalities (or limitations) the service would require in order to scale and which operational processes must be in place to handle and scale the service.

FJONG’s subscription pilot test would have few restrictions in order to observe customer’s natural behaviors and desires.

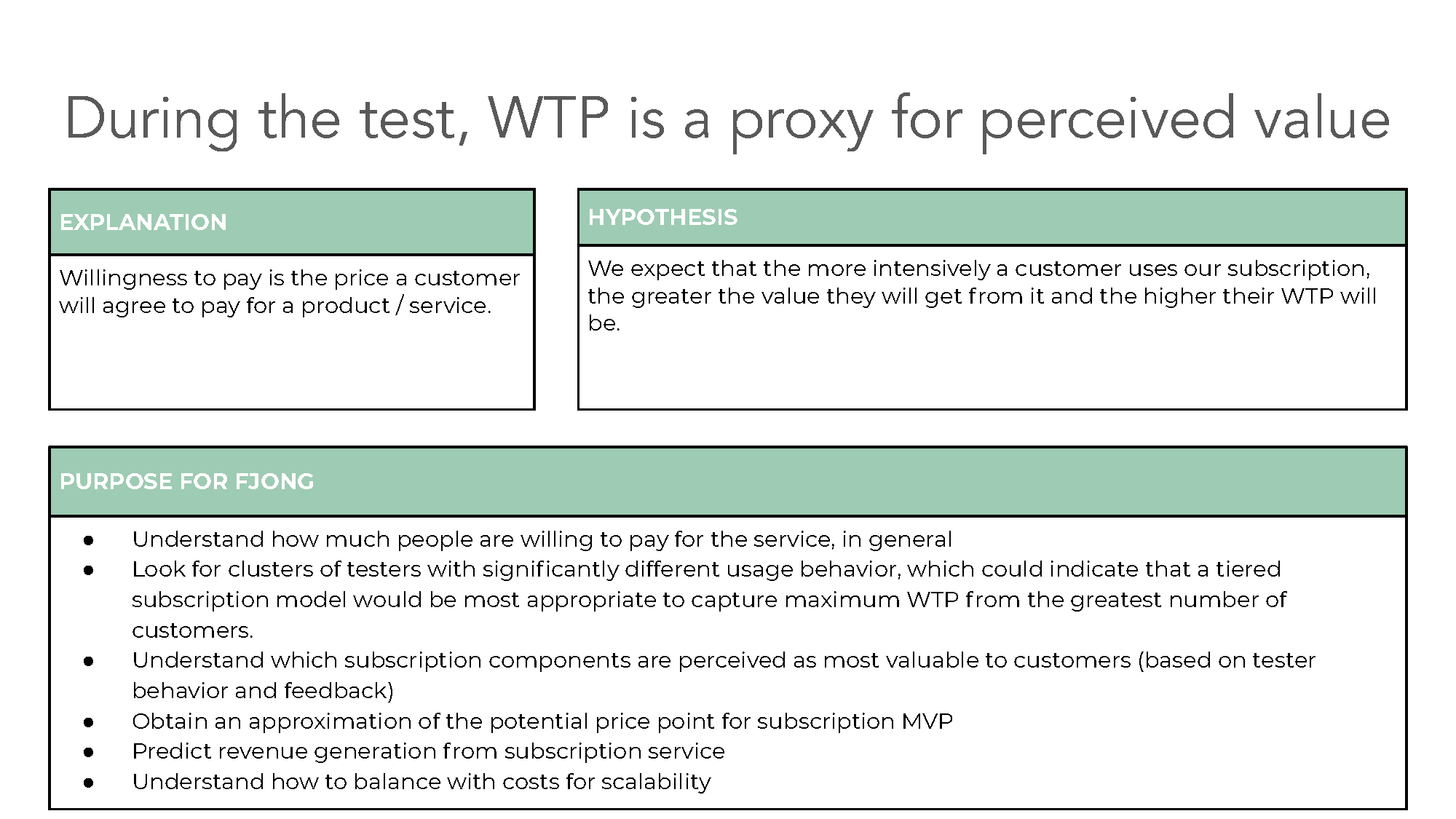

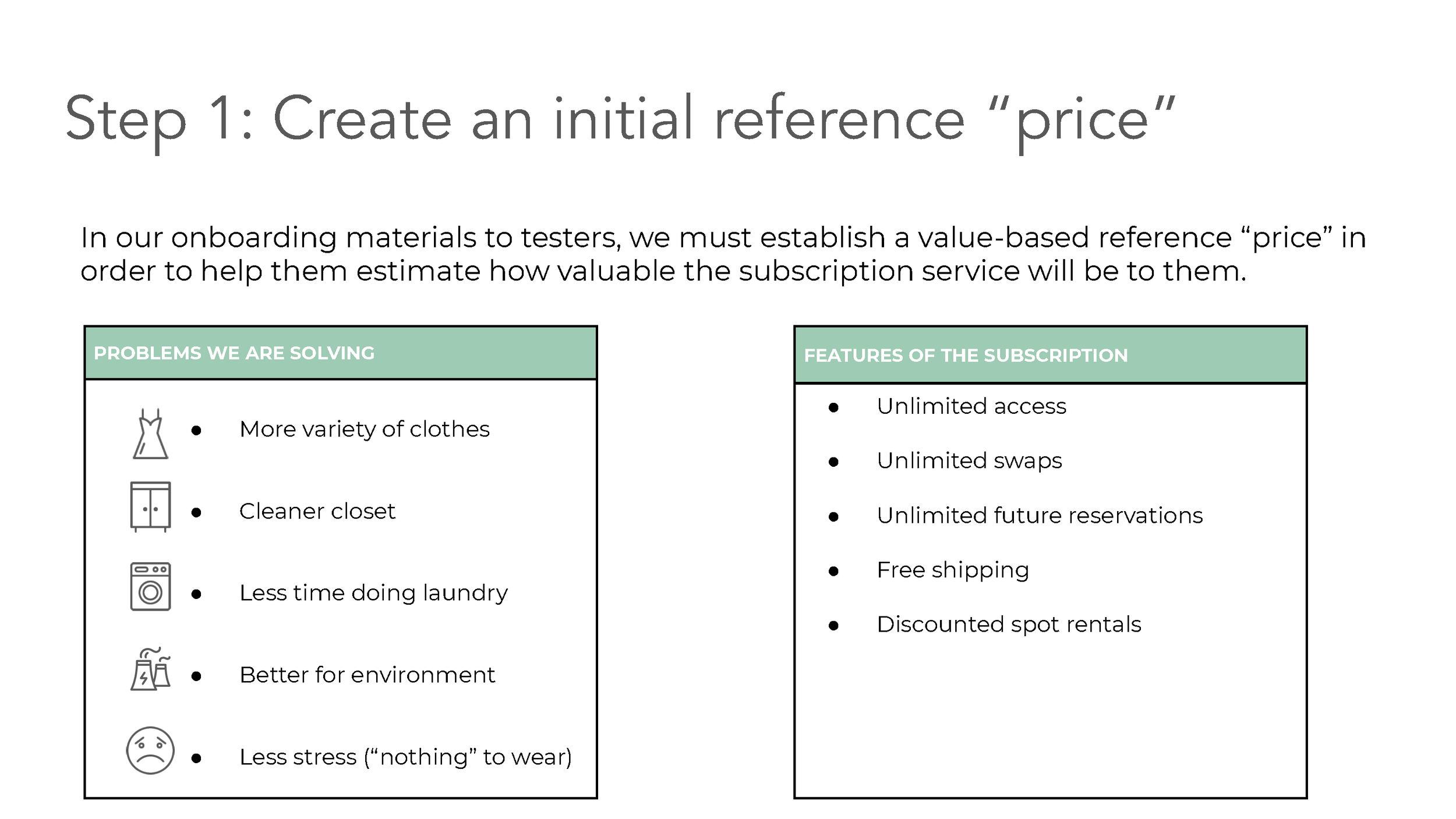

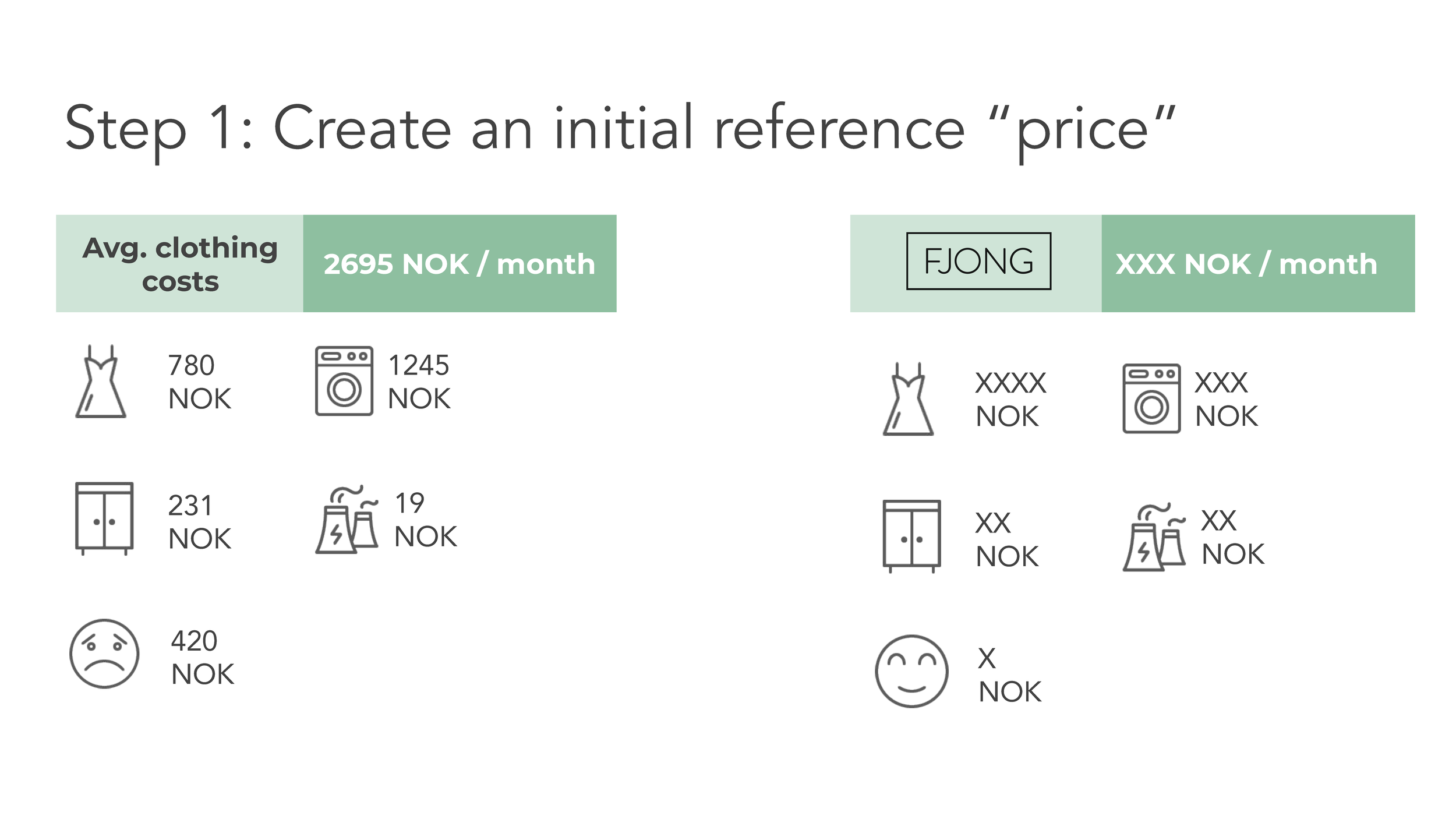

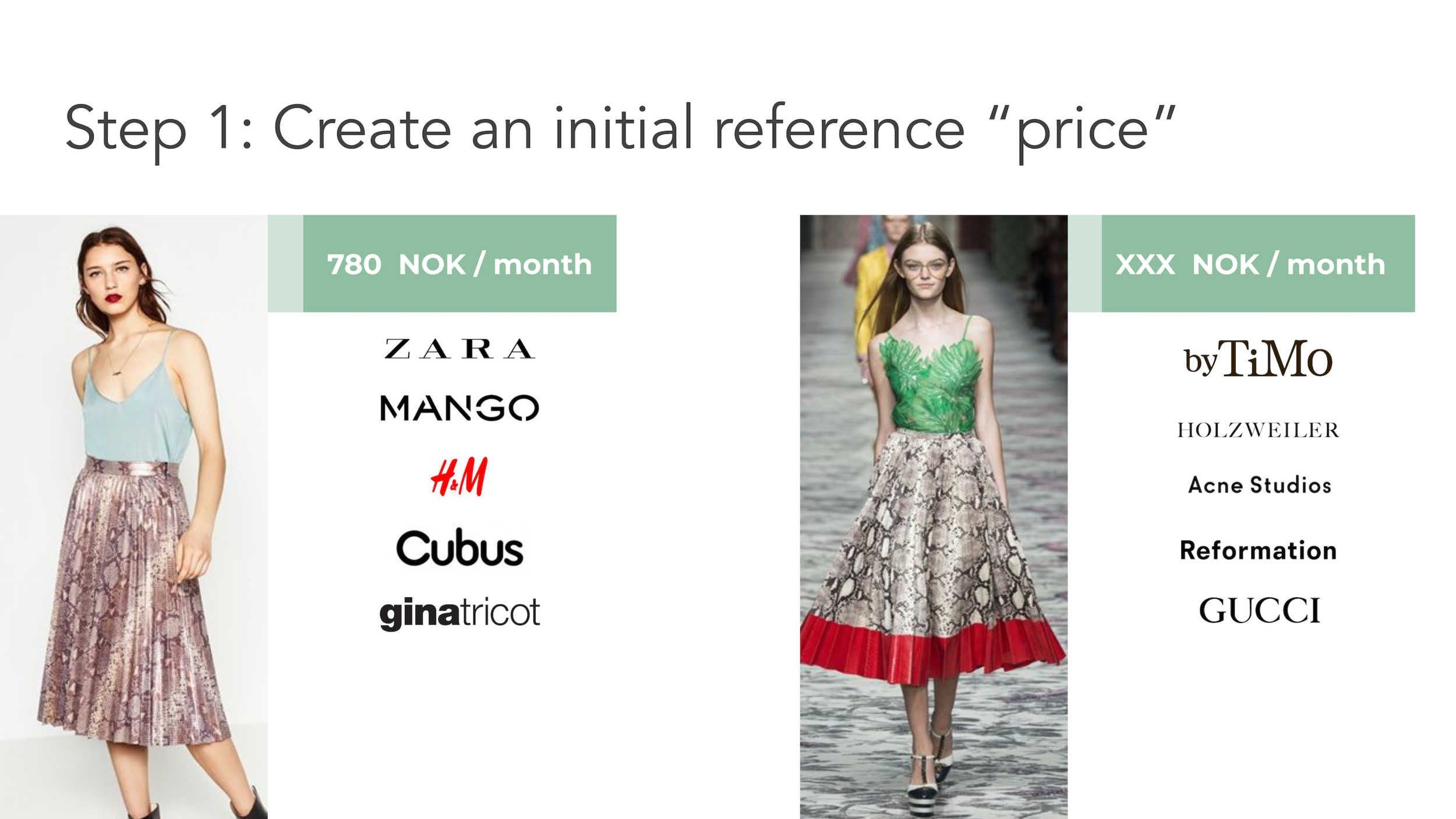

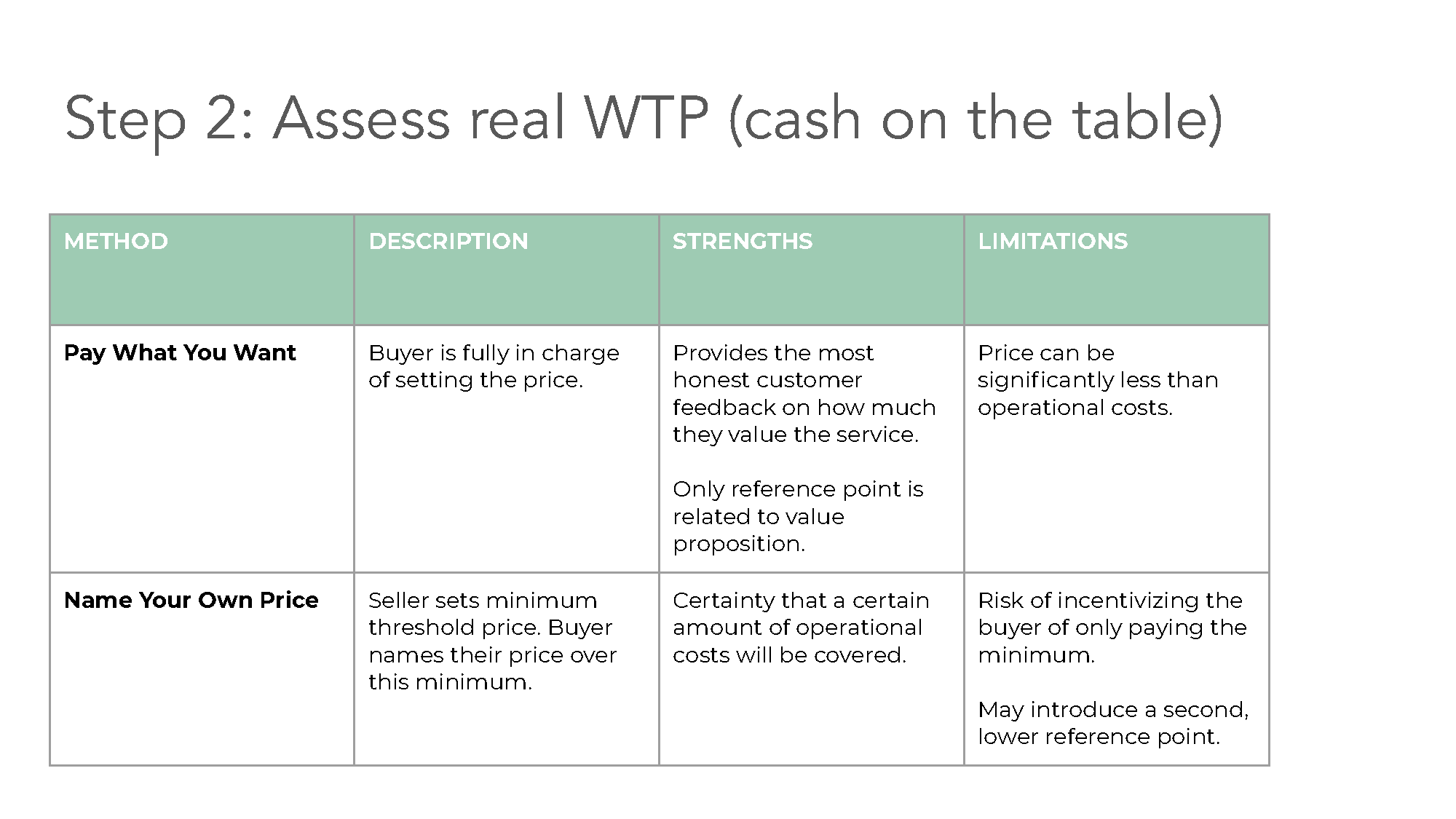

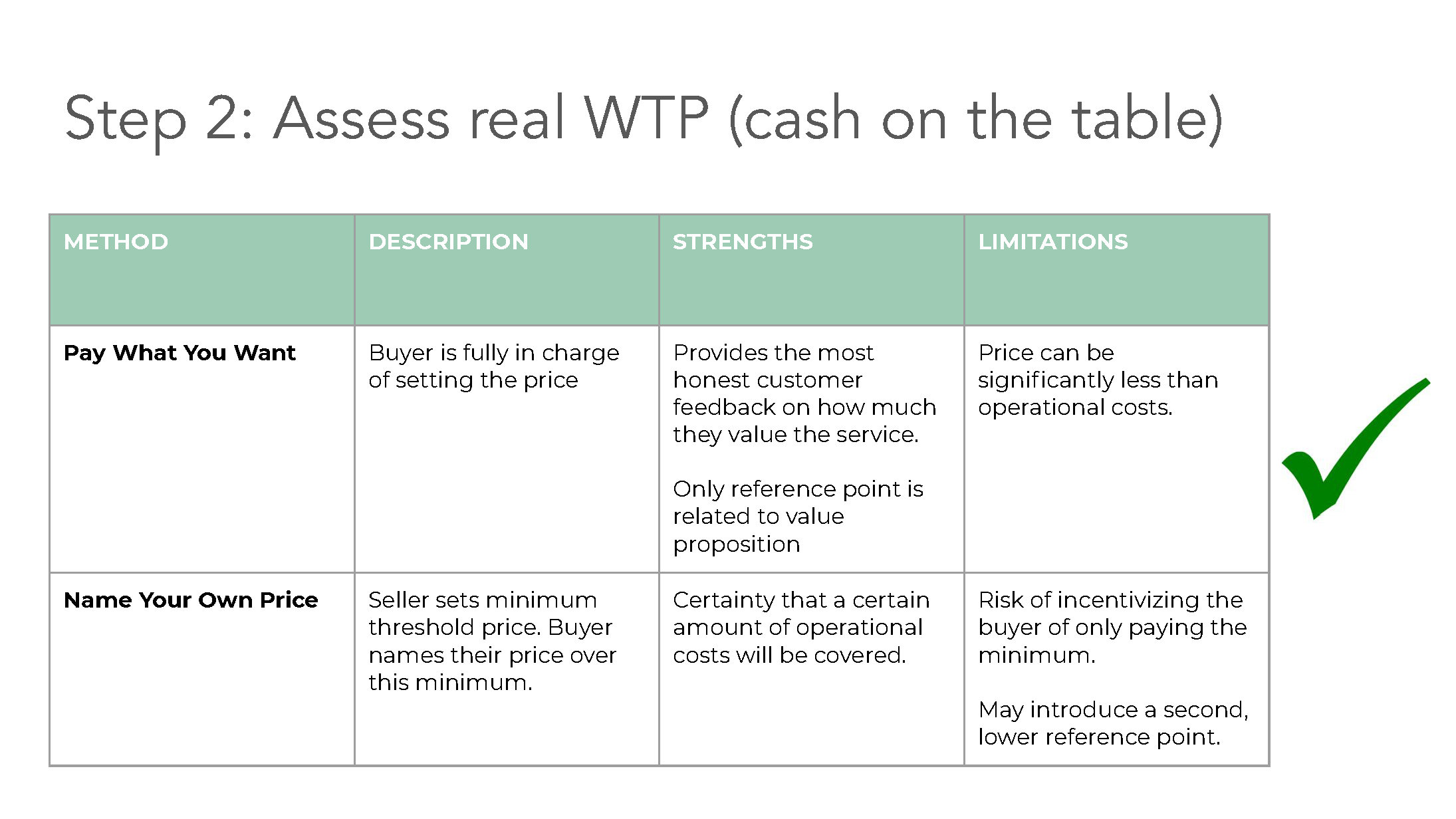

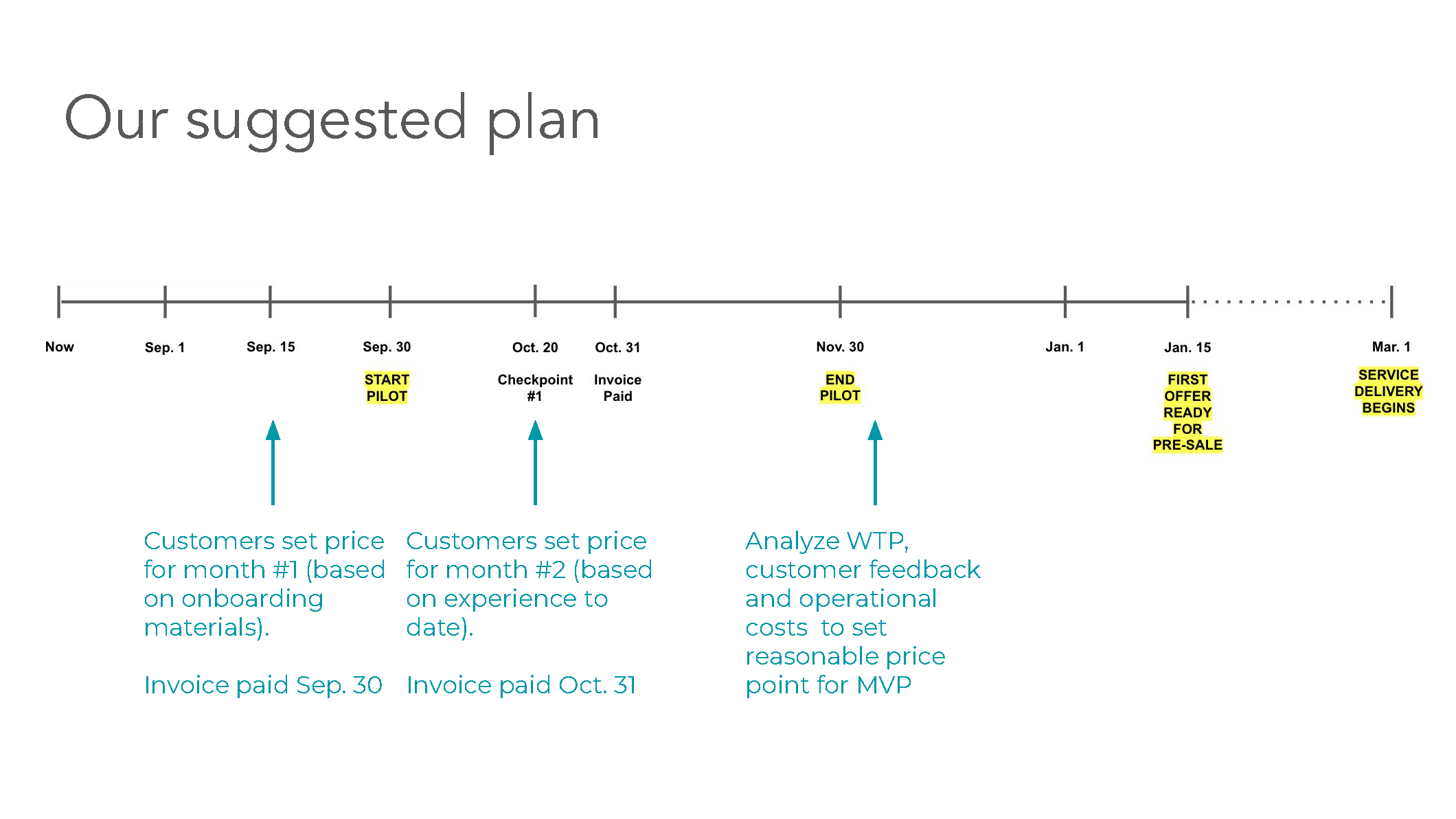

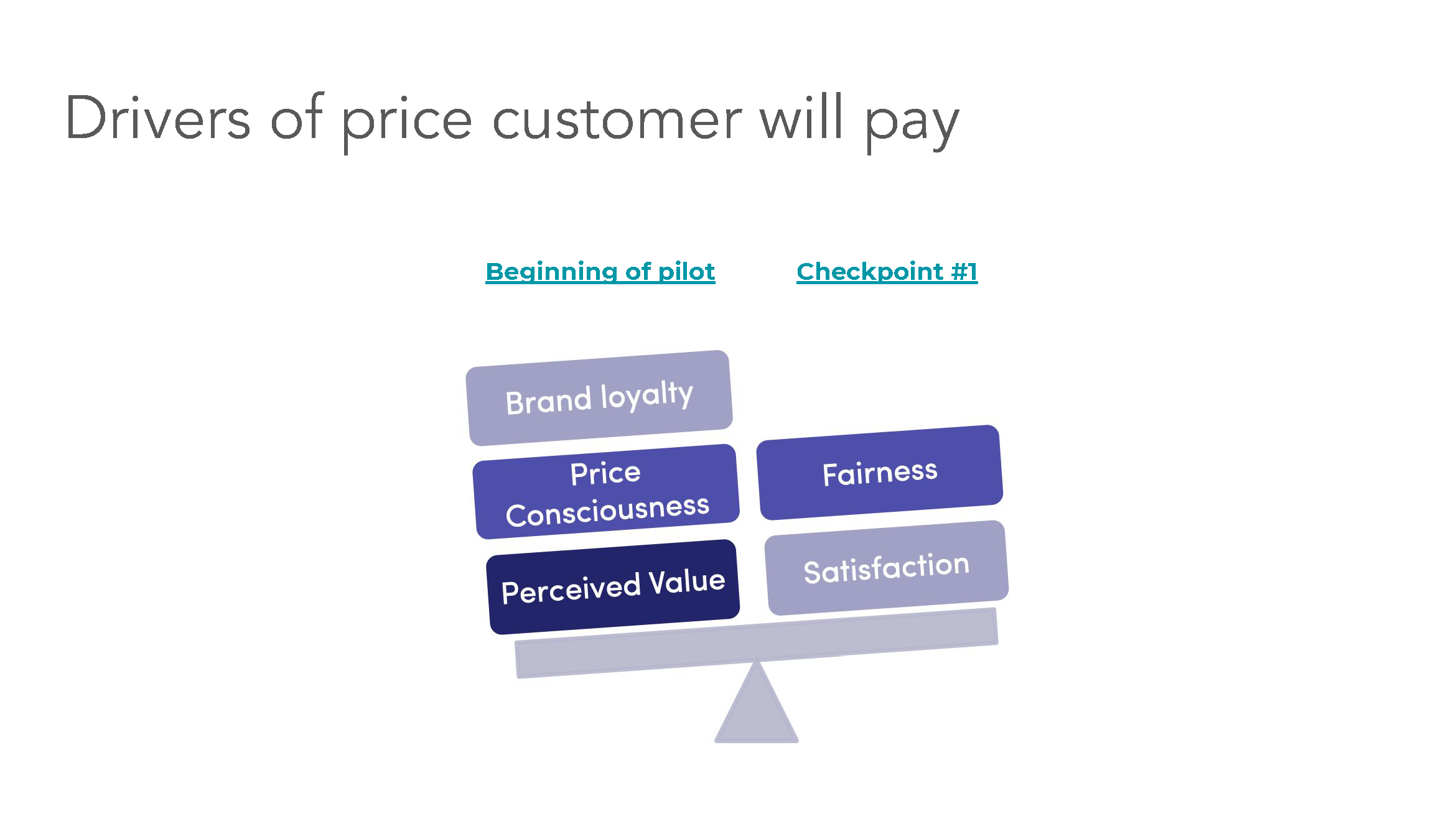

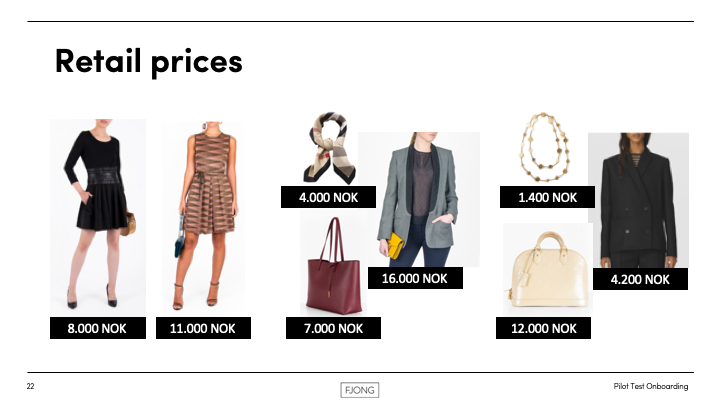

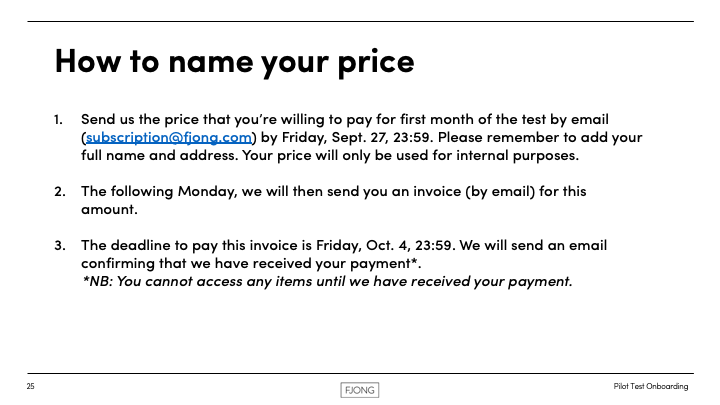

Another goal of the pilot test would be to model the actual willingness to pay (WTP) and costs associated with the average subscriber. We reasoned that the best way to realistically gauge WTP would be for pilot testers to set their own price each month. The first month’s price would be a reflection of expected value and testers would be able to change their price for the second month, signaling whether their expectations were met. This experiment would also allow us to see whether WTP correlated with higher subscription usage or other common factors among our testers.

RUNNING THE PILOT TEST

The goal of our pilot test was to be able to generalize about the behaviour and preference of future FJONG subscription users based on the assumption that they would be similar to our pilot testers. Thus, it was important that our pilot testers well represent our intended market (specifically, those who responded to our FJONG subscription survey and, more generally, FJONG users as a whole). While a larger number of subscribers would make our findings more generalizable, they would also make the pilot test more time consuming to run and increase the risk of losses. Based on an analysis of FJONG’s operational resources and finances, we settled on accommodating 30 pilot testers, who would be as demographically representative of the FJONG audience as possible.

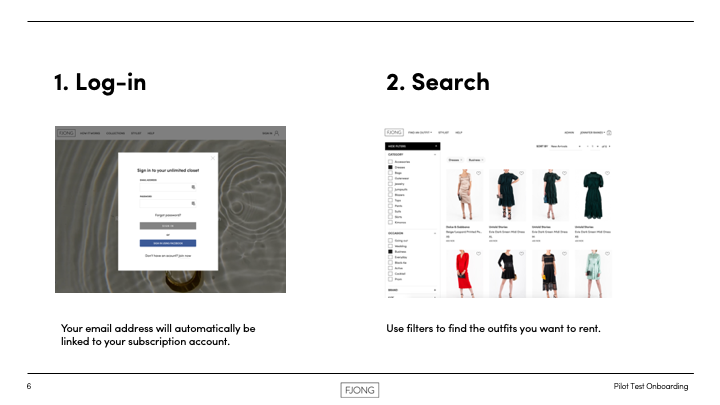

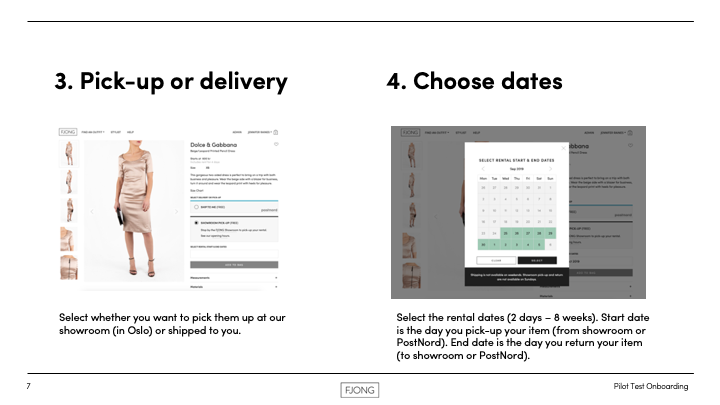

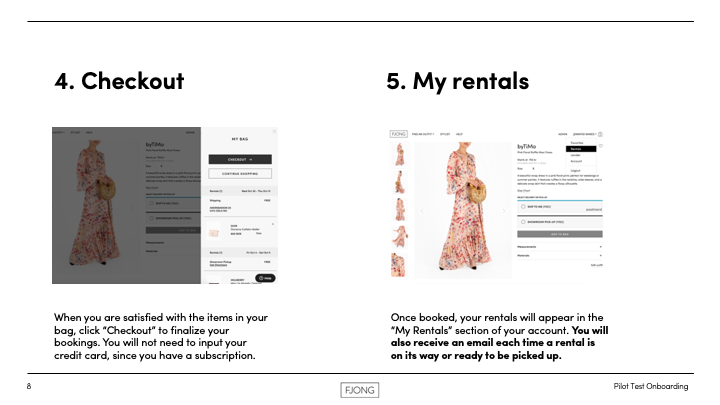

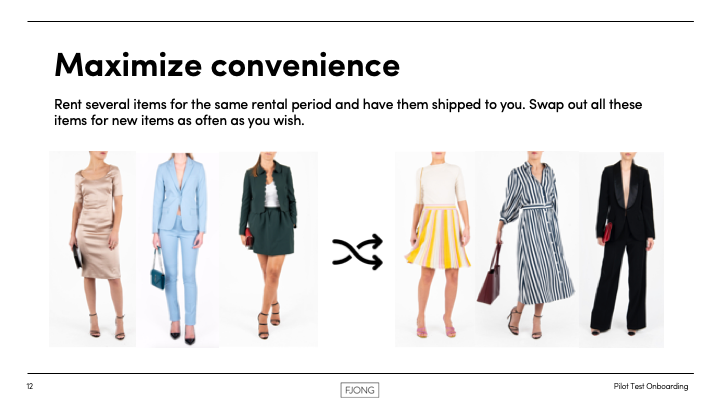

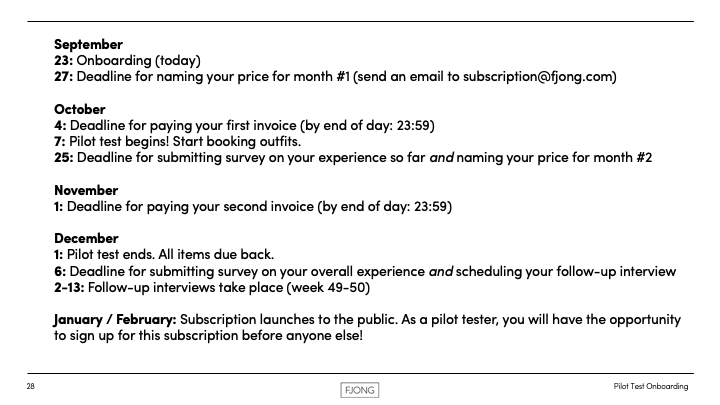

We had worked with FJONG’s tech team to identify and build the core functionalities of a subscription service. Testers would be able to rent multiple items at a time; track their past, current and future rentals in their profile; and receive emails about their status on their rental groups (orders in the mail, time to return, etc.) and FJONG admin would be able to view and process grouped rentals. Given that these features and the entire FJONG subscription concept were new to our pilot testers, we though it important to offer a thorough onboarding to ensure that all of our testers had a clear understanding of how to user the service and what we expected of them in return. As our testers were not all located in Oslo, this onboarding was conducting via an online meeting.

Defining a Beta SUBSCRIPTION

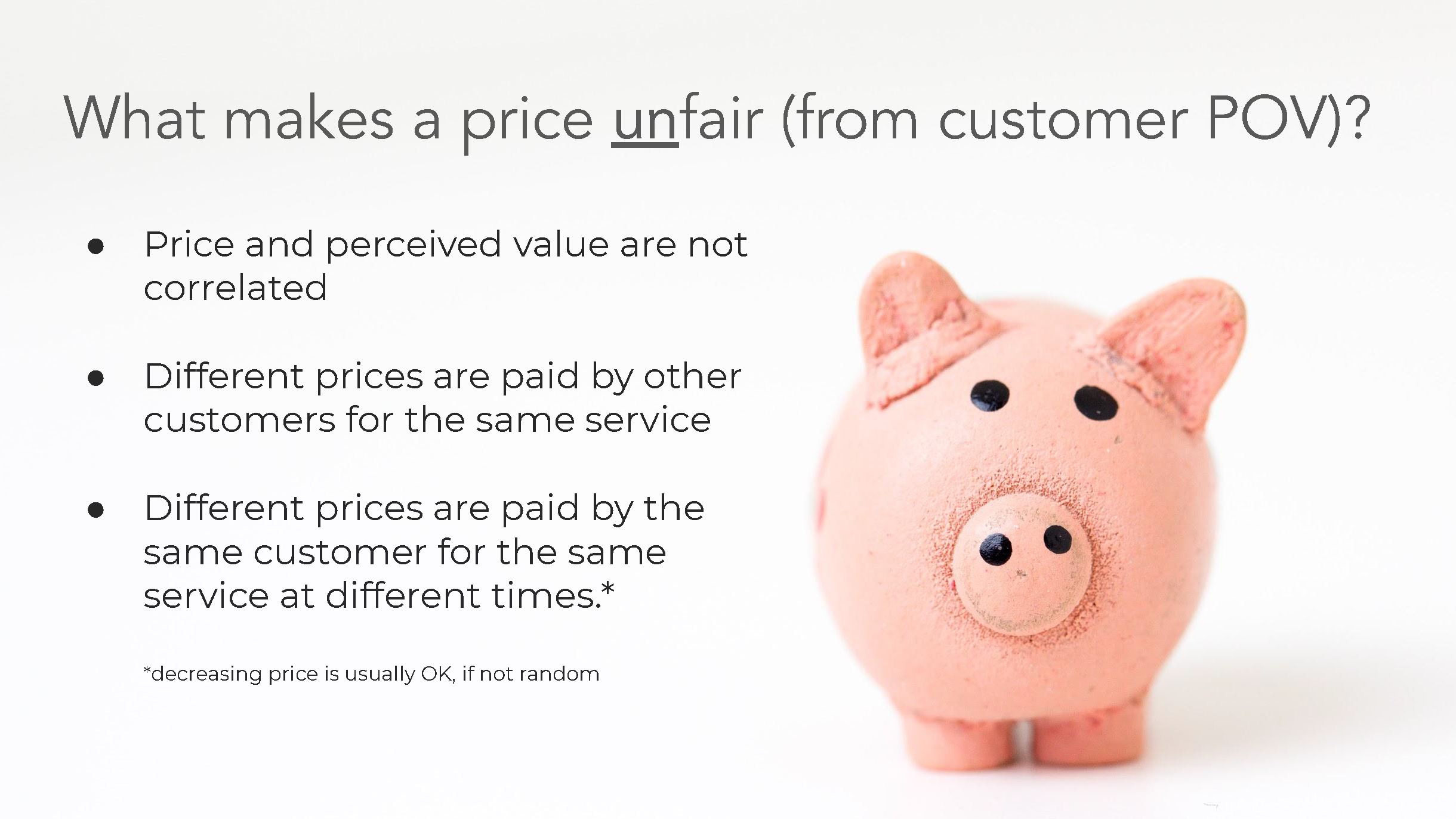

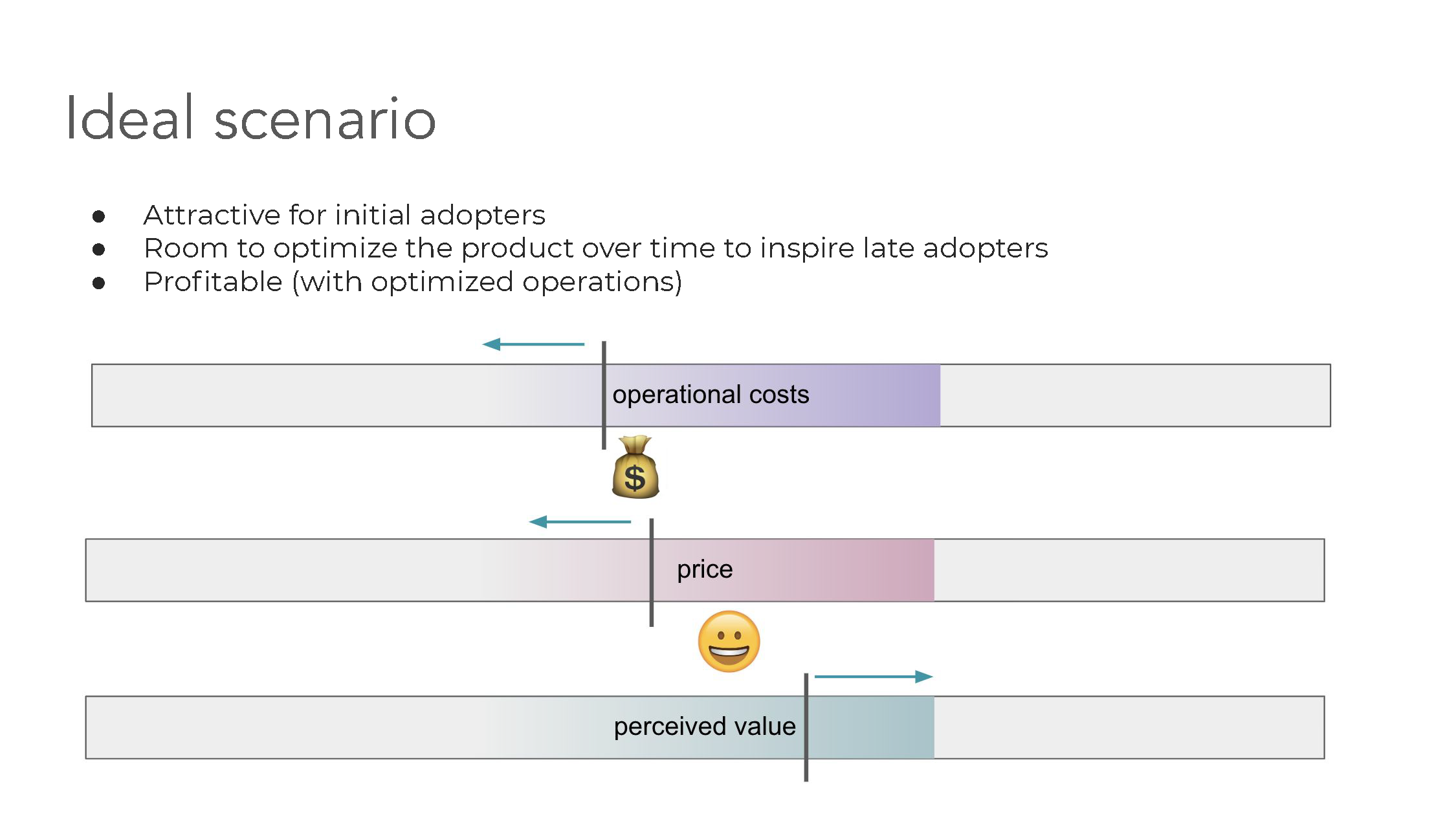

Based on the findings of our pilot test, our next goal was to define a single subscription model to offer to FJONG customers in order to more robustly test its attractiveness and viability and guide further iterations. The initial beta model would need to attractively balance price and value so that further iterations would only improve value and/or lower price, as the reverse would obviously be detrimental to a service that relies on the long-term commitment and ongoing satisfaction of its users (or require that we maintain many different legacy subscription models simultaneously, which was not realistic).

FJONG’s subscription beta model would need to balance price and value so that further iterations would improve value and/or lower price to encourage the ongoing satisfaction and commitment of subscribers.

By comparing different subscription models and prices to our testers behaviour, WTP and other feedback (collected through monthly surveys, formal interviews at the end of the pilot and informal interactions throughout it), we were able to identify what type of subscription model (number of items/swaps, type of items and price) would likely be most attractive to our users (details have been omitted as this service is still in development).

We were also able to identify areas of the service that held the most value to our testers:

Access to a large inventory (with preference for a handful of brands)

Easily understanding when rentals were due to be returned and which rentals were upcoming

A smooth shipping experience

Assurance that their items would look and fit as expected.

By using the data from our pilot testers (estimated conversion rate, retention rate, costs, and value placed on various features), we were able to economically model the consequences of various rollout scenarios. Each scenario was evaluated on three key areas:

Desirability: How attractive would the service be to customers (will attract and retain subscribers)? As the success of a subscription model lies in recurring revenue, retention is especially key—subscribers expectations must be met. The more investment FJONG were to make in developing the parts of the service that are most important to subscribers, the more desirable the service would become.

Viability: Could FJONG support it economically (profit/loss in short/long term)? With scaling in mind, the cost of manual back office processes (low upfront costs but rapidly rising costs with scale) versus investing in development of automated processes (high upfront costs but relatively stable with scale) was important.

Emergence: How much development time would be necessary before launch? It was important to move quickly in order to stay ahead of the competition and begin collecting recurring revenue as soon as possible. Investments in valuable features and automation would obviously take time.

Working with the FJONG management team to weigh these factors, we were able to agree upon a rollout plan in which features with a low development cost and high value (such as a better dashboard to visualize ones rentals) would be implemented immediately and more development intensive features would be rolled out over the coming months, in conjunction with greater numbers of users. Development is currently underway.